If you choose to use points and your chase sapphire reserve credit card to pay for your purchase each point will be worth 0150 but your credit card will be charged the full remaining dollar amount.

Chase sapphire reserve purchase apr.

Chase offers low interest credit cards with an introductory 0 percent apr that can save you money when you transfer your balances.

The rewards rate on the chase sapphire reserve makes it pretty easy to earn ultimate rewards points.

Purchase protection covers your new purchases for 120 days against damage or theft up to 10 000 per claim and 50 000 per year learn more extended warranty protection extends the time period of the u s.

The chase sapphire reserve is the premier travel rewards offering under the ultimate rewards banner.

You can avoid paying interest on purchases and transfers by paying your entire balance by the next due date fees apply for balance transfers.

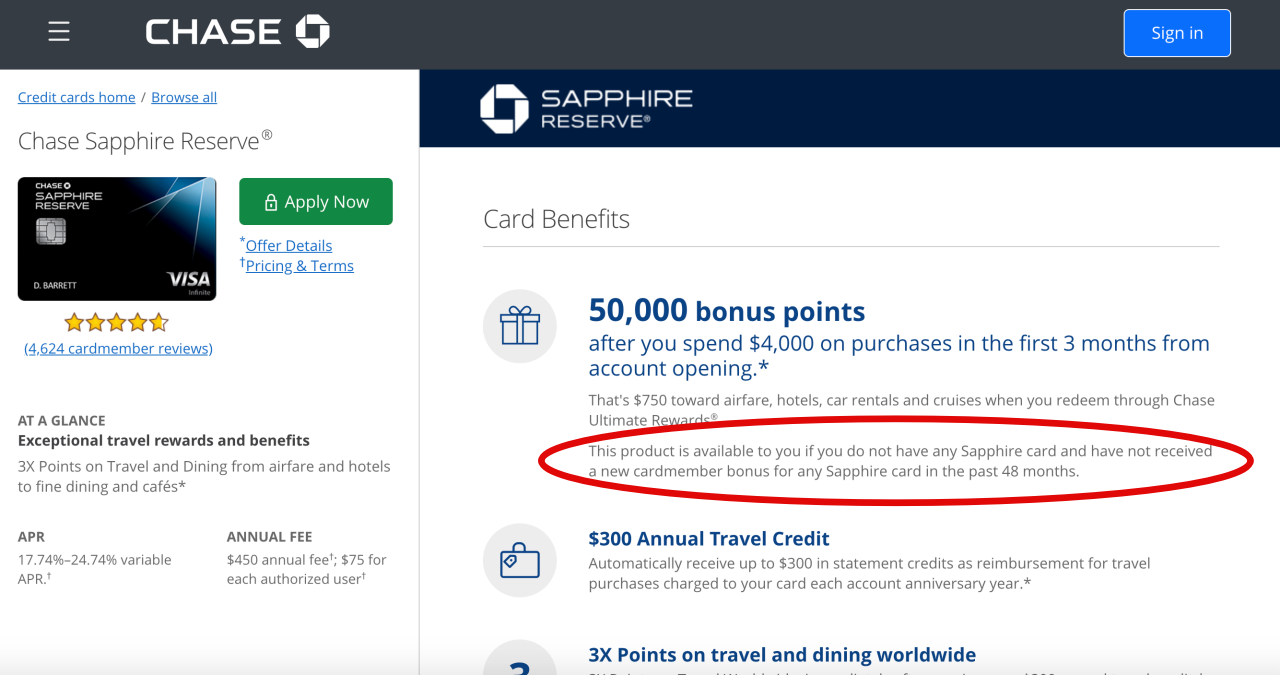

Chase sapphire reserve highlights earn 50 000 points worth 750 in travel when you spend 4 000 on your card within three months of account opening earn 3x points on travel and dining worldwide.

Your exact apr depends on your creditworthiness and can vary with changes to the prime rate.

By way of comparison the chase sapphire.

The apr on the chase sapphire reserve has a purchase apr of 16 99 23 99 variable.

Cardholders earn 3 points per dollar on travel and dining purchases excluding purchases covered by 300 travel credit and 1 point per dollar on everything else.

Apply for a 0 percent interest credit card today.

If you have questions or concerns please contact us through chase customer.

Of course these perks don t come cheap.

And keep in mind that the 48 month rule applies to when you received the bonus not necessarily when you applied for the card.

So if you ve earned a chase sapphire preferred or chase sapphire reserve bonus in the past four years you re out of luck to earn this bonus until you ve passed the 48 month mark.

Through march of 2022 you ll also earn 10 points per dollar on lyft purchases.

/chase-sapphire-preferred-d8cc6e87e5474245b576947076252332.jpg)