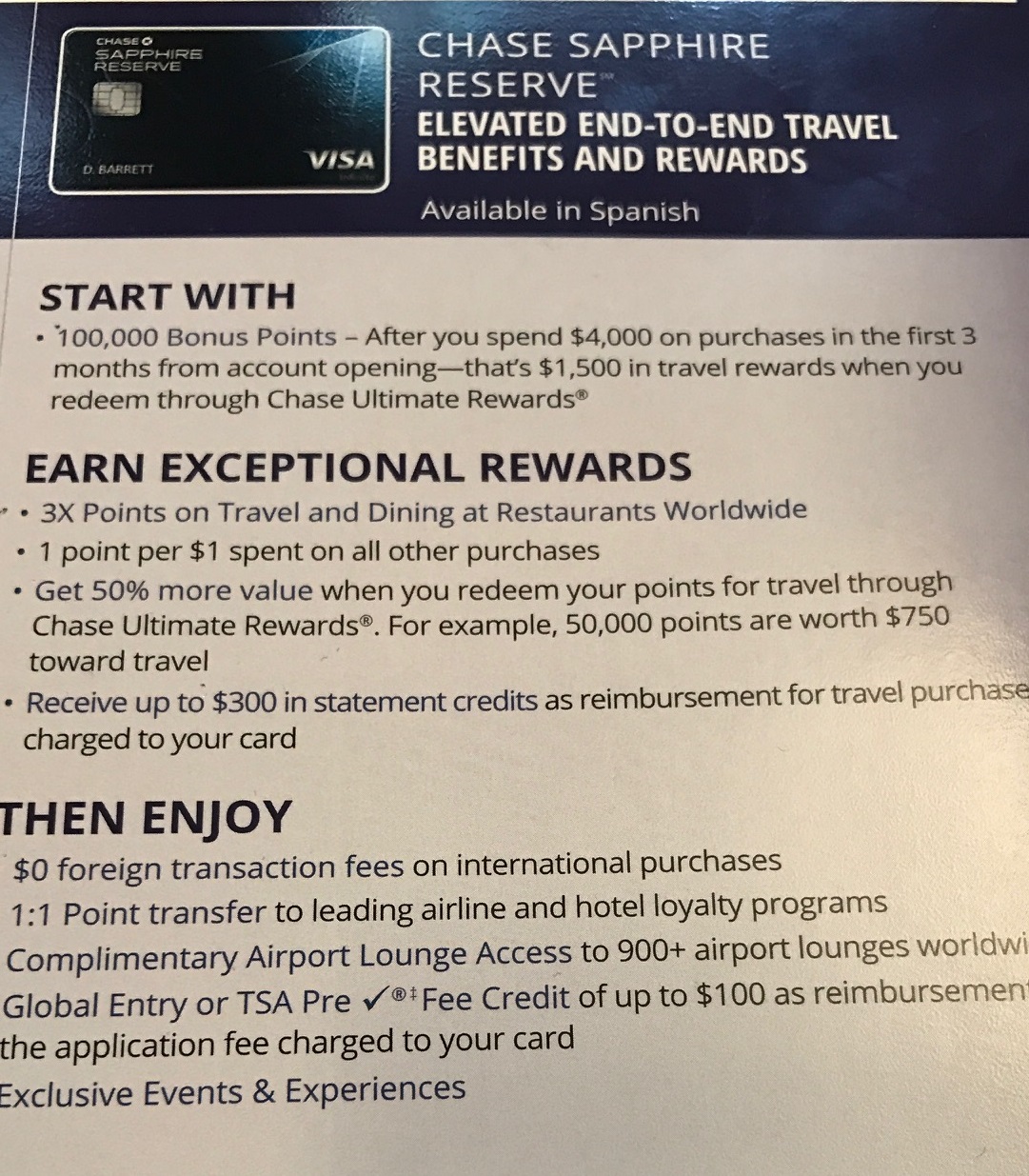

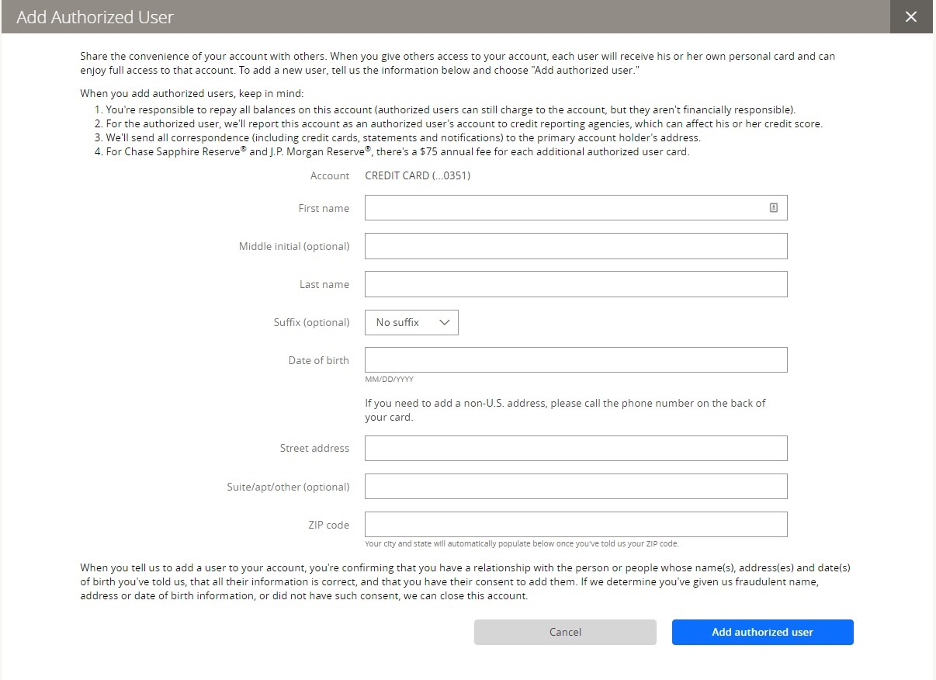

The sapphire preferred costs 95 per year while the sapphire reserve is 450 per year with a 75 fee for each authorized user.

Chase sapphire reserve international transaction fees.

Sapphire cards with no foreign transaction fee.

The chase sapphire reserve foreign transaction fee is 0 as is the case for most travel rewards credit cards.

Both offer bonus points extra points for travel and dining and premium travel benefits.

To offset the annual fee compared to what you would pay if your card had a 3 percent foreign transaction fee.

This means you won t have to pay extra when you buy something from a foreign merchant either in person or online.

But by not paying foreign transaction fees you d only need to spend about 3 200 outside the u s.

Purchases made with these credit cards outside the u s.

Chase sapphire cards are popular choices for travelers as both chase sapphire preferred and reserve have 0 foreign transaction fee.

There may not be a foreign transaction fee but whether your card is sapphire preferred or sapphire reserve there are other fees to remember.

Because the chase sapphire reserve does not charge international fees it s a great card to use when you re traveling outside of the us.

Most cards charge a foreign fee equal to 1 3 of the purchase price.

Chase sapphire foreign transaction fee.

Chase sapphire preferred credit card.

Will not be subject to foreign transaction fees.