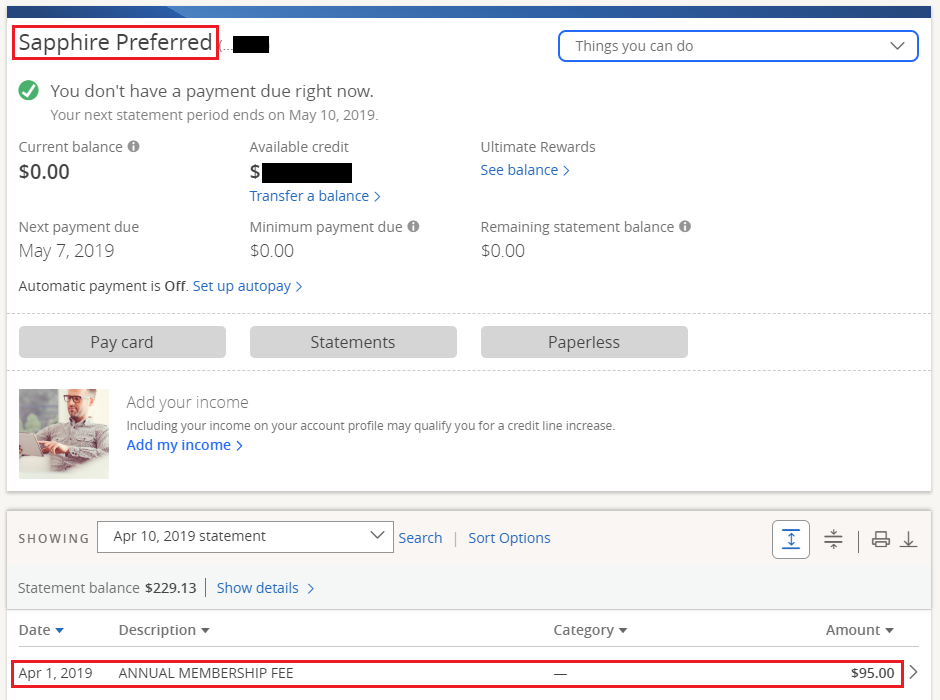

To start earning 2x points on travel and dining apply for the sapphire preferred the chase sapphire preferred card is one of the most popular travel reward cards on the market.

Chase sapphire preferred income requirements.

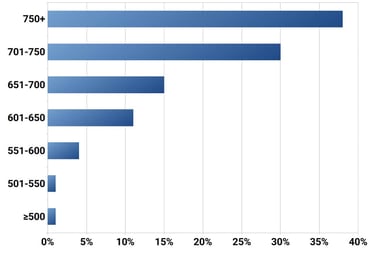

If you have a decent credit history a few accounts 3 to 5 years old or more a decent score somewhere close to 720 and an income of 50 000 you probably have some good odds of being approved.

The chase sapphire preferred card is one of the consistently highest rated travel rewards cards on the market.

Cardholders generally have a higher income above 50 000.

Chase sapphire preferred card calculator.

Grocery stores and dining at restaurants including takeout and eligible delivery services home improvement stores such as home depot and lowe s and select.

But it s not so easy to get.

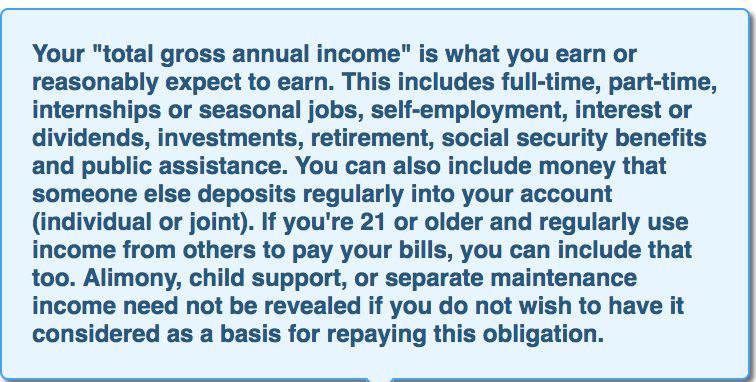

If your income is too low chase may not be comfortable extending that much credit.

Sapphire preferred is broadening your world of benefits.

Be sure your income is enough to qualify.

The minimum credit limit for the sapphire preferred is 5 000.

There is no required minimum income for chase sapphire preferred.

Once your account is opened we will send you a guide to benefits which includes a full explanation of coverages.

Apply for a sapphire preferred travel credit card today.

Plus this will allow you to earn a higher welcome bonus of 80 000 ultimate rewards points worth 1 600 based on tpg.

However it s an important factor that chase will consider.

The chase sapphire preferred is a great card and chase won t just approve anyone for it.

Final word on chase sapphire preferred approval odds.

Chase just released its highest ever welcome bonus.

Since the chase sapphire preferred is a visa signature card the minimum credit limit is 5 000.

If you ve been eyeing the chase sapphire reserve but your score aligns better with the chase sapphire preferred you can apply for the csp with the lower score requirement and then request a product change to the csr.

Between its generous signup offer and market leading rewards rates not to mention its sleek metal design it s no wonder the chase sapphire preferred card reigns supreme among those looking to maximize both value and rewards flexibility.

If you re unsure about your eligibility but have an above 700 credit score still apply for chase sapphire preferred for a chance to earn rewards when dining and traveling.

Eligible new chase sapphire preferred card applicants can earn 80 000 bonus points after spending 4 000 on purchases in the first three.

There are specific time limits and documentation requirements.

/chase-sapphire-preferred-d8cc6e87e5474245b576947076252332.jpg)